What is Contango and Backwardation

She gives some great perspective on what is going on at the SEC from her vantage point and how the exchange tries to position itself among its competitors in the spot bitcoin ETF race. Nasdaq is seeking to become the first US exchange to list a spot bitcoin ETF. Get this delivered to your inbox, and more info about our products and services. Supply disruptions, weather events, and geopolitical events can also contribute to backwardation in markets. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. An author, teacher & investing expert with nearly two decades experience as an investment portfolio manager and chief financial officer for a real estate holding company.

A normal backwardation market—sometimes called simply backwardation—is confused with an inverted futures curve. Contango exists for multiple reasons including inflation, carry costs (storage and insurance), and expectations that real prices will be higher in blue ocean meaning the future. Backwardation is rare, given that prices typically rise due to inflation as well as storage costs. For example, if a supply shortage emerges, that could cause backwardation, as market participants pay a premium for the immediate delivery of gold.

In general, backwardation can be the result of current supply and demand factors. It may be signaling that investors are expecting asset prices to fall over time. Producers have other reasons to pay more for futures than the spot price. Producers make commodity purchases as needed based on their inventory. How they manage their inventory may be influenced by the spot price vs. the futures price.

But conditions could change quickly and if prices fall, those trades could lose money. Traders with access to physical oil and storage can make substantial profits in a contango market. Other traders may seek to profit on a storage shortage by placing a spread trade betting on the contango structure of the market to increase. In this situation, the market could be oversupplied, which is why spot prices are significantly lower than futures prices. The spot price refers to the current price for immediate delivery, while the futures price refers to the price at which a futures contract for an asset can be bought or sold. This happens for many reasons, such as greater than expected demand, inflation and supply disruptions.

2008 world food price crisis

There is always the possibility that the market will fall to levels far below the price you’ve agreed to pay, causing losses. In this scenario, the one-month futures contract might be priced at $72 per barrel, while the six-month futures contract might be priced at $75 per barrel. This price difference between the contracts reflects the cost of storing the oil and other factors such as interest rates and future market expectations. Contango and backwardation are terms used to define the structure of the forward curve. When a market is in contango, the forward price of a futures contract is higher than the spot price. Conversely, when a market is in backwardation, the forward price of the futures contract is lower than the spot price.

As mentioned previously, traders can profit from short-selling opportunities created by contango. Introduction For traders who trade on margin, understanding your buying power is essential to staying on the right side of margin requirements. Tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services.

If the commodity in question is subject to contango, then this would lead to a steady rise in the prices being paid for these futures contracts. Over the long run, this can significantly increase the costs borne by the ETF, placing a downward drag on the returns earned by its investors. Futures prices above the spot price can signal higher prices in the future, particularly when inflation is high. Speculators may buy more of the commodity experiencing contango in an attempt to profit from higher expected prices in the future. They might be able to make even more money by buying futures contracts. However, that strategy only works if actual prices in the future exceed futures prices.

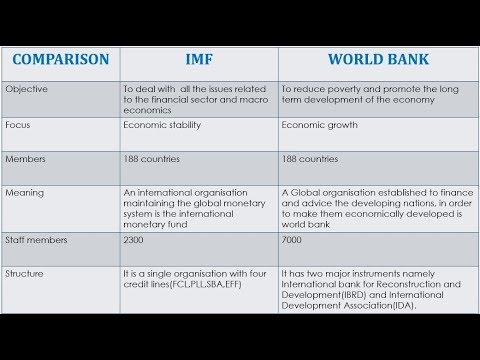

Contango vs. Normal Backwardation: An Overview

Contango is considered to be a bullish sign – the wider markets expect the price of the underlying commodity to increase in the future. This fee was similar in character to the present meaning of contango, i.e., future delivery costing more than immediate delivery, and the charge representing cost of carry to the holder. Short squeezes can introduce a lot of volatility into stocks and send share prices sharply higher. These squeezes offer opportunities for trading, but they often require different strategies and more caution than traditional breakouts.

These scenarios create opportunities for investors to generate a profit by taking advantage of the market dislocations. This action also simultaneously helps to bring spot prices and futures contracts back into alignment. Investors trade in commodities as a way to diversify their portfolios and take advantage of the price fluctuations of goods. Commodities are broadly categorized as one of four types – metal, energy, livestock and meat and agricultural. You can invest in commodities through futures contracts, options and exchange-traded funds (ETFs).

What is Backwardation, How it Works, Contango Differences – tastylive

What is Backwardation, How it Works, Contango Differences.

Posted: Thu, 29 Jun 2023 10:25:52 GMT [source]

Contango and backwardation are terms to refer to the shape of the futures curve for a given commodity or financial asset. Examples would include gold, oil, agricultural products, bitcoin, and volatility on the S&P 500. All of these have various prices at different dates, and thus there’s a curve of prices between today and future contracts.

How Does Contango Affect Commodity Exchange-Traded Funds (ETFs)?

Most futures investors are speculators who don’t want to have to deal with how to handle thousands of barrels of oil or thousands of bushels of corn. For them, the natural thing to do is to close out their futures positions right before the contracts expire. After they do so, many speculators simply turn around and open a similar position on a futures contract at some point in the future. The terms contango and backwardation both refer to current conditions in a futures market for a given commodity.

For most commodities, there are a relatively small number of futures market participants who are actually interested in buying or selling the underlying commodity good. Similarly, farming operations might sell crop futures to processed food manufacturers that need those crops as ingredients for their prepared food items. In these cases, these parties will hold onto their futures contracts until expiration and then make good on whatever delivery responsibilities are called for under the contracts. When contango occurs, investors must pay more attention to their futures contracts within their portfolios. This can lock in losses when futures contracts expire at higher prices than the spot prices. These rolling forward contracts are typically limited to commodity ETFs, such as oil ETFs, which do not hold physical commodities.

On the other hand, markets tend to move into backwardation when there’s widespread agreement that an asset’s current price will decline in the future. For example, if an economic recession is expected to develop at some point in the future, the market may go into backwardation to account for slowing demand, which often has a negative impact on price. Markets tend to move into backwardation when there’s widespread agreement that an asset’s current price will decline in the future. For example, if an economic recession is expected to develop, markets may go into backwardation to account for slowing demand, which often has a negative impact on price. Contango is a condition that occurs in commodities and futures markets where the price of a given good is lower today than the price in the future.

What is backwardation?

In the event that the price is at $0 for a given month, as oil was in 2020, this could potentially destroy a fund as it would have no capital with which to buy the next month’s futures. Some oil funds were restructured following that incident to attempt to lower risk of a blow-up event in the future. The market is said to be in a state of contango when traders are willing to pay less for a commodity https://1investing.in/ today than they are at a later date. If the futures prices show a rising slope with a price of, say, $2000 to buy an ounce of gold five years from now in the futures market, that would be contango. The opposite of this, backwardation, is when prices are higher today than in the future. A market is “in backwardation” when the futures price is below the spot price for a particular asset.

Partners break ground on Alaska gold mine – North of 60 Mining News

Partners break ground on Alaska gold mine.

Posted: Thu, 31 Aug 2023 07:00:00 GMT [source]

However, investors and traders can consider several different approaches in a contango market to try and make a profit—assuming one of the strategies fits the investor/trader’s outlook and risk profile. Over time, as the futures contract approaches maturity, the futures price will converge with the spot price, otherwise an arbitrage opportunity would exist. Contango is a situation where a commodity’s futures contract price has decreased to converge with the actual price on the day of delivery.

What is Backwardation

This is also a sign of volatility spikes, which can trigger from demand shock and/or supply disruption. If traders are all jumping into storing oil as part of a contango trade, the price for storage will likely increase as it is in greater demand. Floating storage on oil tankers is in greater demand during contango periods.

Make sure you understand that any investment involves risk and that price expectations in futures markets are just predictions, not guaranteed. You could track commodities markets though for information to help your stock trades. For example, if oil has gone into steep contango, this could be good news for oil companies and bad news for airlines.

Contango, sometimes referred to as forwardation, is the opposite of backwardation. In the futures markets, the forward curve can be in contango or backwardation. The premium usually includes the cost of carry, which is a term that refers to the costs of holding an asset for a certain period. The cost of carry for commodities generally includes storage, insurance, or depreciation due to spoiling or rotting if the commodity is an agricultural or meat product. When prices are in contango, investors are willing to pay more for a commodity that will be delivered in the future. The difference between the spot and future prices is referred to as a premium.

If futures contracts are involved to take on synthetic positions (rather than owning the actual commodity), then be aware of the embedded value decay and erosive nature of the contango effect. The trade would lose money if the market reverts to a normal backwardation structure. In backwardation, the spot price is higher than the price for farther-out contracts. Say the price of oil two months out goes to $59, while the spot price goes to $60. That said, contango markets may also experience sharp price changes due to unexpected developments in the market.

The opposite of contango is “normal backwardation.” Besides being a clumsy term, normal backwardation is the situation where the futures prices of a commodity follow a downward-sloping curve. This creates a situation where the future price of a commodity is lower than the price today. While normal backwardation is fairly rare, it is typically the result of anticipated declines in demand for a commodity, expectations of deflation or a short-term excess in supply. In general, futures contracts represent an upward slope in the prices of goods over time.

Overall, futures markets involve a substantial amount of speculation. When contracts are further away from expiration, they are more speculative. But there are several reasons a trader would want to lock in a higher futures price. As mentioned, the cost of carry is one common reason for buying commodities futures. Spot prices, on the other hand, are what a commodity would sell for if you were to buy it right now and take immediate delivery. So, if futures prices are higher than spot prices, it means traders expect prices to rise.

No testimonial should be considered as a guarantee of future performance or success. Supply disruptions, weather events, and geopolitical events can also contribute to backwardation. A covered call is a common strategy that is used to enhance a long stock position. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

- Traders with access to physical oil and storage can make substantial profits in a contango market.

- The gold market may therefore trade in contango or backwardation, much like any other commodities market.

- If futures contracts are involved to take on synthetic positions (rather than owning the actual commodity), then be aware of the embedded value decay and erosive nature of the contango effect.

- Over the ensuing months, the economy regains its footing and the spot price of oil starts to rally back up to the long-term price of $70 per barrel.

The opposite of contango is backwardation, when futures prices are lower than spot prices. Futures contracts are inherently speculative, but contango and backwardation are standard market conditions because investors have different views about the future. The significant difference for investors, then, is how to trade during these conditions. The effects of extreme contango and backwardation can result in the malfunction and breaking of ETF products. On April 23rd, 2020, investors and traders were witness to an unprecedented event when May crude oil futures went negative the day before expiration sinking to negative (-) $34 per-barrel. Backwardation may be a result of the futures contract’s current supply and demand factors.

Responses